Incredible Tips to Strive On your Normal Insurance coverage Needs

Your beloved ones, and their care, must be the most important thought in your life. It's essential to have covered yourself with an excellent life insurance policy so you can proceed to care in your cherished ones when you could have handed on. The advice offered in this article will help you alongside in the process of choosing life insurance that may provide for you and your beloved ones' needs.

When buying life insurance coverage, it is crucial that you know how your broker will likely be paid. If they are working strictly on fee, for instance, your needs could also be secondary to selling you a coverage that offers the perfect fee. Find The best Life Insurance coverage Data To help you at all on your broker can lead to a battle of interest, so at all times ask to see all of the alternative merchandise before shopping for.

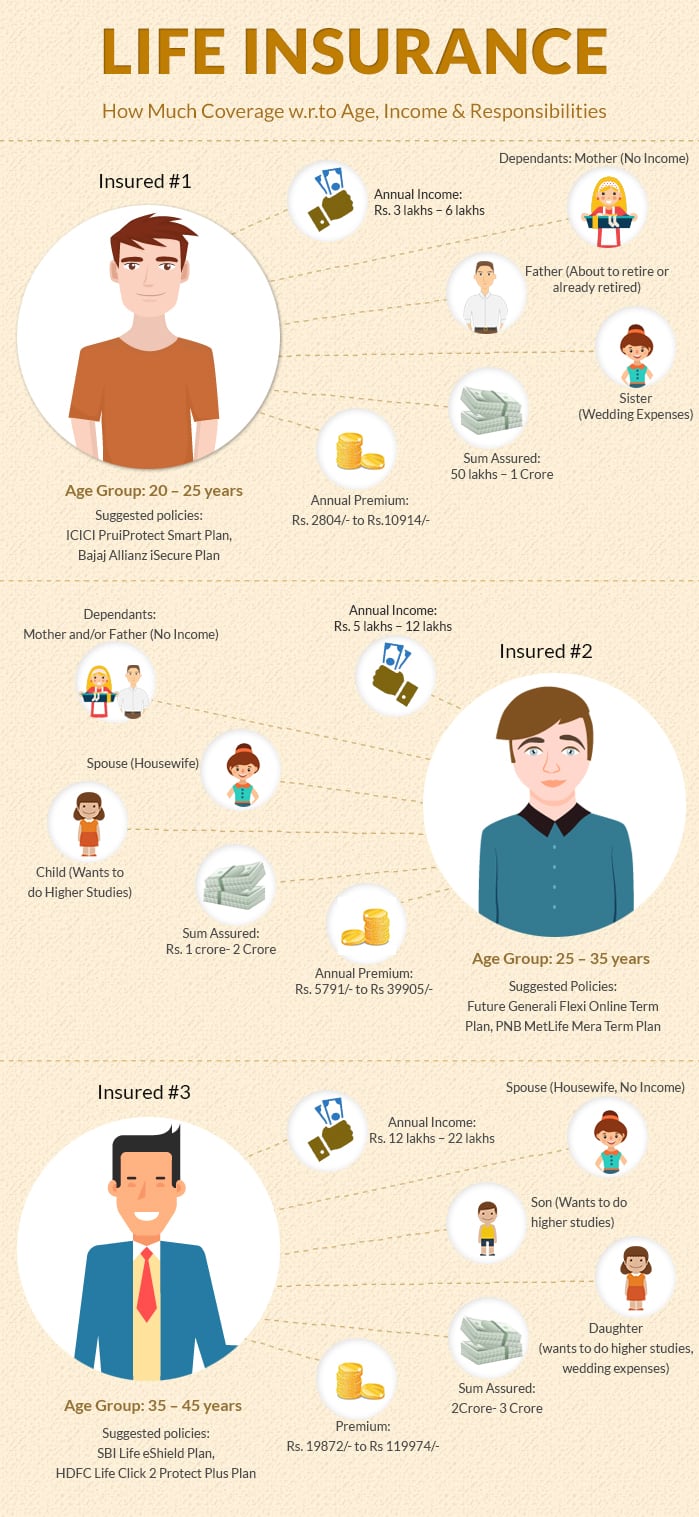

Many individuals purchase time period life insurance when they're youthful because it's cheap. Others are persuaded to purchase complete life insurance, which, not like time period, has a cash worth and may presumably be considered as an funding. If you are in good well being, time period is generally the perfect value. Try to lock in time period insurance coverage for the longest potential timespan you could find. When it runs out, if you are still in good health, keep on the lookout for time period. Most of the time, whole life might be costlier, however as you age, term life can even get fairly costly to cowl the inevitable health issues that will crop up. Remember: time period life as lengthy because it is sensible ratewise, then swap to complete life.

Attempt to lead a healthy way of life. The healthier you are the cheaper your life insurance will be as insurance coverage providers assume that you will stay longer. Remember, you can be expected to pay a excessive premium on a life insurance coverage policy for anything that shortens your life expectancy, for instance being overweight, smoking, taking sure medicine, and so on.

Earlier than buying a life insurance policy, be sure to look into the quality of the corporate you're shopping for it from. In case you purchase a life insurance coverage coverage from a low-quality firm, they will not be round to pay out when it turns into obligatory. Worse, there are many individuals on the market trying to rip-off you out of your money by impersonating a life insurance salesman. All the time check up on the status of the company and the salesperson before you sign something.

When getting life insurance, make sure to get a policy that provides mortgage safety. What this does is assist repay your mortgage or some other debts whenever you pass away. That is vital as a result of it helps relieve your cherished ones of your financial debts when you are now not alive.

All of us would love to go away our family a lot of wealth when we pass on, but you must keep away from taking out very large insurance policies if you wouldn't have the means to make the month-to-month word. The trouble right here is that while trying to purchase that massive policy, your payments may lapse and you may lose it.

Questioning about the amount of life insurance coverage you need? First, it is best to ask yourself whether or not you absolutely need to pay for a coverage. The reply is most certainly 'no' in case you are single and don't have any kids. A good ballpark estimate is to have a policy that covers your annual salary between 5 to 10 times over.

Before you buy life insurance, determine what sort of coverage you will need. Prime Ideas For Selecting the best Life Insurance coverage comprises a large number of online calculators that will help you figure out the amount of cash your partner or youngsters would wish in the event of your demise. Using any such software will assist ensure that you're purchasing solely what it's a must to have.

Understanding what you want on the subject of life insurance coverage shouldn't be always simple to determine. Consider your loved ones and your excellent debts. You must have a coverage that gives for these items within the event of your death. Purchase a policy from time to time iron out the details of your wants.

To avoid wasting Confused By Life Insurance? This article Can assist on your life insurance, go for a term life policy. This policy is the easiest and finest choice for individuals from the age of twenty to across the age of fifty. In Selecting Life Insurance Could be Made Simpler are over fifty and relatively wealthy, you possibly can choose instead for cash value life insurance coverage.

To save lots of cash in your life insurance policy, improve your threat class by getting in shape. Something as simple as shedding weight, lowering your blood strain and cholesterol, or quitting smoking can prevent a significant amount of cash. You should definitely take a medical exam as nicely before you apply for life insurance coverage to insure you aren't surprised by further fees.

To save cash in your life insurance coverage, understand the distinction between time period insurance and everlasting life insurance coverage. Term insurance coverage should cover most financial want and debt, and it will not be necessary for you to purchase an expensive everlasting complete life policy. Purchase what you at present need, and then make adjustments if your wants change.

Look for an insurance coverage company that present a components that helps you determine how a lot money your family will need after you're gone. Make sure that your life insurance covers things similar to funeral expenses, exciting debts and can pay sufficient money to your family for them to maintain their standards of living.

If you haven't any dependents, you're most likely not seeing the purpose of getting life insurance coverage. But subscribing to a life insurance implies that your funeral expenses will likely be coated. Your relations will significantly appreciate this and when you subscribe to a more intensive coverage, it is possible for you to to leave some cash to the relations of your alternative.

As you have now discovered, life insurance coverage is essential to provide for your loved ones if something dangerous should ever occur to you. Following the advice in this text will give you the peace of mind, knowing that you've got achieved what is best for them.